Employer / Self employed Member | Personal Account Member | Obtain Fund Information | Manage Your Account | About AMTD MPF Scheme | Personal Info Collection Statement / Automatic Exchange of Financial Account Information | Key Scheme Information | eMPF Information

Key Scheme Information

- Why is MPF important to you?

- Your MPF contributions

- How do we invest your money?

- What are the risks of your MPF investment?

- How to transfer your MPF?

- How to manage your MPF when changing jobs?

- When should you adjust your MPF fund choices?

- When can you withdraw your MPF?

- Additional information useful to you

- How to make enquiries and complaints?

- Why is MPF important to you?

- Your MPF contributions

- How do we invest your money?

- What are the risks of your MPF investment?

- How to transfer to your MPF?

- How to manage your MPF when changing jobs?

- When should you adjust your MPF fund choices?

- When can you withdraw your MPF?

- Additional information useful to you

- How to make enquiries and complaints?

Why is MPF important to you?

The Mandatory Provident Fund (MPF) System aims at assisting the working population of Hong Kong to accumulate retirement savings by making regular contributions. Employees (full time or part-time) and self-employed persons aged 18 to 64, except the exempt persons, are required to participate in an MPF scheme.

To facilitate your retirement planning, you

may use MPFA’s Retirement Planning

Calculator to calculate:i)your retirement needs;ii)

your projected MPF and other

retirement savings upon your

retirement; andiii) how much you need to

save to meet your

retirement needs.

If you are an employer, you need to know your MPF obligations,

including enrolling new employees,

making contributions and reporting terminated employees. If you have any questions

relating to your

MPF obligations as an employer, please contact us.To

become a participating employer of the Scheme, please submit the completed application

form,

which will constitute the participation agreement between the Sponsor, the Trustee and

the

participating employer.

Applications can be obtained from eMPF Service Centres or download from:empf.org.hk/forms/en

Your MPF contributions

If you are an employee (full time or part-time),

both you and your employer are required to make regular

MPF contributions for you, based on your “relevant income” as follows:

| Monthly Relevant Income | Mandatory Contribution Amount | |

|---|---|---|

| Employer’s Contributions | Employee’s Contributions | |

| Less than HK$7,100 | Relevant income x 5% | Not required |

| HK$7,100 to HK$30,000 | Relevant income x 5% | Relevant income x 5% |

| More than HK$30,000 | HK$1,500 | HK$1,500 |

“Relevant income” refers to wages, salaries, leave pay, fees, commissions, bonuses,

gratuities, perquisites

or allowances, expressed in monetary terms, paid or payable by an employer to an employee,

but excludes

severance payments or long service payments under the Employment Ordinance.

All contributions are immediately vested in you, except for the MPF derived from the

employer’s

contributions for offsetting severance payments or long service payments.

If you are self-employed, you are required to make MPF contributions as follows:

| Relevant Income | Self-employed Person’s Contributions | |

|---|---|---|

| Annual | Monthly Average | |

| Less than HK$85,200 | Less than HK$7,100 | Not required |

| HK$85,200 to HK$360,000 | HK$7,100 to HK$30,000 | Relevant income x 5% |

| More than HK$360,000 | More than HK$30,000 | HK$360,000 x 5% = HK$18,000 per year or HK$30,000 x 5% = HK$1,500 per month |

Whether you are an employee or self-employed, you may also consider making additional contributions (i.e. Voluntary Contributions (VC), Tax Deductible Voluntary Contributions (TVC) and Special Voluntary Contributions (SVC)) in light of your personal needs.

| How to Open an Account | Voluntary Contributions | Tax Deductible Voluntary Contributions | Special Voluntary Contributions |

|---|---|---|---|

| Your employer helps you open an account under the MPF scheme chosen by the company. | You select your own MPF scheme and open an account on your own. | You select your own MPF scheme and open an account on your own. |

For details of different types of contributions, you may refer to the MPF Scheme

Brochure of the Scheme –

Administrative Procedures Section which is available via the link and the QR code:MPF Scheme Brochure

How do we invest your money?

Upon joining the Scheme, if you have not given the Trustee any investment instructions,

your

money will be invested under the Default Investment Strategy (DIS) automatically. For

details of

the DIS, you may refer to the MPF Scheme Brochure of the Scheme – Fund Options,

Investment

Objectives and Policies Section which is available via the link and the QR code:MPF Scheme Brochure

Alternatively, you can choose to invest in the following funds

| No. | Name of Constituent Fund | Investment Manager | Fund Descriptor | Investment Focus | s I | Management

fees

|

|---|---|---|---|---|---|---|

| 1 | AMTD Invesco Age 65 Plus Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global –Maximum equity – 25% |

Around 20% in equities, around 80% in bonds with balance in cash |

To achieve stable growth by investing in a globally diversified manner. |

0.75% |

| 2 | AMTD Invesco Core Accumulation Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global –Maximum equity – 65% |

Around 60% in equities, around 40% in bonds with balance in cash |

To achieve capital growth by investing in a globally diversified manner. |

0.75% |

| 3 | AMTD Invesco MPF Conservative Fund |

Invesco Hong Kong Limited |

Money Market Fund – Hong Kong |

Deposits and debt securities |

To preserve capital with minimal risk. This constituent fund does not guarantee the repayment of capital. |

0.90% |

| 4 | AMTD Invesco Asia Fund |

Invesco Hong Kong Limited |

Equity Fund – Asia (excluding Japan) |

Up to 100% in equities with balance in cash |

To achieve long term capital appreciation. |

1.00% |

| 5 | AMTD Invesco Europe Fund |

Invesco Hong Kong Limited |

Equity Fund – Europe (including the United Kingdom) |

Up to 100% in equities with balance in cash |

To achieve long term capital appreciation. |

1.00% |

| 6 | AMTD Invesco Global Bond Fund |

Invesco Hong Kong Limited |

Bond Fund – Global | Up with tobalance 100% ininbonds cash | To achieve steady growth over the long term. |

1.00% |

| 7 | AMTD Invesco Hong Kong and China Fund |

Invesco Hong Kong Limited |

Equity Fund – Hong Kong and China |

Up to 100% in equities with balance in cash |

To achieve long term capital appreciation. |

1.00% |

| 8 | AMTD Allianz Choice Dynamic Allocation Fund |

Allianz Global Investors Asia Pacific Limited |

Mixed Assets Fund – Global – Maximum equity – 50% |

Up to 50% in equities, normally at least 75% in bonds and cash |

To achieve performance target not related to an index, and long term capital preservation with minimized short term volatility. |

最高 0.97% |

| 9 | AMTD Allianz Choice Capital Stable Fund |

Allianz Global Investors Asia Pacific Limited |

Mixed Assets Fund – Global – Maximum equity 40% |

30% in equities, 70% in bonds with balance in cash |

To achieve capital preservation combined with steady capital appreciation over the long term. |

最高 0.97% |

| 10 | AMTD Allianz Choice Stable Growth Fund |

Allianz Global Investors Asia Pacific Limited |

Mixed Assets Fund – Global – Maximum equity 60% |

50% in equities, 50% in bonds with balance in cash |

To achieve a stable overall return over the long term. |

最高 0.97% |

| 11 | AMTD Allianz Choice Balanced Fund |

Allianz Global Investors Asia Pacific Limited |

Mixed Assets Fund – Global – Maximum equity 80% |

70% in equities, 30% in bonds with balance in cash |

To achieve a high level (above market) of overall return over the long term. |

最高 0.97% |

| 12 | AMTD Allianz Choice Growth Fund |

Allianz Global Investors Asia Pacific Limited |

Mixed Assets Fund – Global – Maximum equity – 100% |

90% in equities, 10% in bonds with balance in cash |

To maximize long term overall returns. |

最高 0.97% |

| 13 | AMTD Invesco Target Retirement Now Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global – Maximum equity around 30% |

30% in equities, 70% in bonds with balance in cash |

To achieve capital preservation over the long term whilst seeking to enhance returns through limited exposure to global equities. |

1.00% |

| 14 | AMTD Invesco Target 2028 Retirement Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global – Maximum equity around 48% |

48% in equities, 52% in bonds with balance in cash |

To provide capital appreciation and current income through its allocation of assets consistent with the target date of retirement. |

1.00% |

| 15 | AMTD Invesco Target 2038 Retirement Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global – Maximum equity around 65% |

65% in equities, 35% in bonds with balance in cash |

To provide capital appreciation and current income through its allocation of assets consistent with the target date of retirement. |

1.00% |

| 16 | AMTD Invesco Target 2048 Retirement Fund |

Invesco Hong Kong Limited |

Mixed Assets Fund – Global – Maximum equity around 82% |

82% in equities, 18% in bonds with balance in cash |

To provide capital appreciation and current income through its allocation of assets consistent with the target date of retirement. |

1.00% |

Note –

The management fees shown in the table above include the management fees chargeable by

the fund and its underlying fund(s) only. There may be other fees and charges chargeable

to the fund

and its underlying fund(s) or to you. For details, please refer to the MPF Scheme

Brochure of the

Scheme – Fees and Charges Section, which is available via the link and the QR code:MPF Scheme Brochure。

To help you make comparisons across different MPF funds and schemes, you may refer to

the information on the MPF Fund

Platform via the link: https://mfp.mpfa.org.hk/tch/mpp_index.jsp

。

What are the risks of your MPF investment?

Investment involves risks. Please refer to the

MPF Scheme Brochure of the Scheme – Risks Section for

details of the risk factors to which the funds are exposed, which is available via the

link and the QR code:MPF Scheme

Brochure。

A risk class is assigned to each fund with reference to a seven-point risk classification

scale based on the latest

fund risk indicator of the fund. A fund in a higher risk class tends to show a greater

volatility of return than a

low-risk class fund. Information about the latest risk class of each fund is set out in

the latest Fund Fact Sheet

of the Scheme, which is available via the link:Fund Fact Sheet。

How to transfer your MPF?

If you are an employee, you may opt to

transfer your MPF derived from employee mandatory contributions

in your contribution account under current employment (Original Scheme) to any other MPF

schemes of your

choice (New Scheme) once a year1. If your transfer involves selling your

interests in a guarantee fund, please

check with the trustee of the Original Scheme the terms and conditions of the guarantee

fund as failure to

fulfil some qualifying conditions may cause the loss of guaranteed returns. Your

contribution account under

current employment may consist of different parts of MPF derived from different sources

and subject to

different transfer rules, as follows:

| Parts of MPF in a contribution account(i.e. Types of contributions that the MPF are derived from) | Transfer rule | Type of account receiving the MPF |

|---|---|---|

| Contributions from current employment | ||

| Employer mandatory contributions | Not transferable | – |

| Employee mandatory contributions | Transferable once every calendar year1 | Personal account |

| Employer voluntary contributions | Subject to the governing rules of the Original Scheme | |

| Employee voluntary contributions | ||

| Contributions from former employment | ||

| Mandatory contributions transferred to the contribution account under current employment | Transferable at any time | Personal account or other contribution accounts2 |

| Voluntary contributions transferred to the contribution account under current employment | Subject to the governing rules of the Original Scheme | |

If you are a self-employed person or tax deductible voluntary contribution (TVC) account

holder, you can

transfer your MPF held in your MPF contribution account, personal account or TVC account

to any other

MPF schemes of your choice at any time.

1

Unless the governing rules of the Original Scheme provide for more frequent

transfer-out.

2 Only applies to employees with two or more contribution accounts.

If an employee is employed by more

than one employer at the same time, he/she may have more than one contribution

account.

How to manage your MPF when changing jobs?

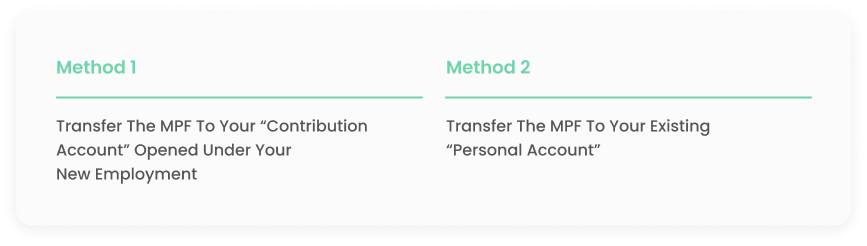

You should proactively manage the MPF accumulated during your previous employment in one of the following ways:

If you do not have any personal accounts, and you are satisfied with the MPF scheme

chosen by your

former employer, you may consider retaining your MPF in a personal account under the

scheme of your

previous employment for investment.

Forms for transfer of MPF can be downloaded

via the link and/or QR code:

If you have any questions relating to transfer of MPF, please contact us.

When should you adjust your MPF fund choices?

In general, it is a good practice to review your fund choices regularly and adjust your MPF fund choices as you think fit.

How to adjust your MPF fund choices?

- You may submit to the Trustee a new investment mandate or a switching instruction form, which is available via the following QR codes: Download forms from: empf.org.hk/forms/en Email address: forms@support.empf.org.hk

-

You may send your new investment instructions by mail,

facsimile.

Mailing address: P.O. Box 98929, Tsim Sha Tsui Post Office

eMPF Service Centres:

Hong Kong Island: Unit 601B, 6/F, Dah Sing Financial Centre, No. 248 Queen’s Road East, Wan Chai, Hong Kong

Kowloon: Suites 1205-6, 12/F, Chinachem Golden Plaza, No. 77 Mody Road, Tsim Sha Tsui East, Kowloon

New Territories: Suite 1802A, 18/F, Tower 2, Nina Tower, No. 8 Yeung Uk Road, Tsuen Wan, New Territories

Fax Number: 852 3197 2988

- In order that your instructions can be processed within the next dealing day, you must submit your instructions to the Trustee before the relevant cut-off time. For details, please refer to the MPF Scheme Brochure of the Scheme – Administrative Procedures Section which is available via the link and the QR code:MPF Scheme Brochure 。

When can you withdraw your MPF?

Once you reach the age of 65, you are entitled

to withdraw your MPF. In addition, by law you can

withdraw your MPF early on the following six grounds: early retirement after reaching

the age of 60,

death, total incapacity, terminal illness, permanent departure from Hong Kong or small

balances. You

may elect to have your MPF paid in a lump sum or by instalments upon reaching 65 or

early retirement

after reaching 60, and you may also elect not to withdraw your MPF at the age of 65.

The six grounds for early withdrawal of your MPF:

The law does not stipulate any deadlines for withdrawing MPF. You should consider your

personal needs

before making a withdrawal application. If you choose to retain all your MPF in your

account, no

application is required. Your MPF will continue to be invested in the fund(s) you have

selected.

Forms for withdrawal of MPF can be downloaded via the link and/or QR code:https://bit.ly/2PrRXiM

If you have any questions relating to withdrawal of your MPF, please contact

us.

Additional information useful to you

Taxation

Employees are allowed to claim salaries tax deduction for their mandatory contributions, subject to a maximum deduction of $18,000 per year. Contributions that are made to TVC accounts may also be eligible for tax deduction. We recommend that you seek professional advice regarding your own tax circumstances.

Documents from the Scheme

Scheme members will receive the following documents:

1. Upon joining the scheme: this KSID and the Notice of Participation; and

2. Within three months after the Scheme year end: the Annual Benefit Statement.

Other information

his KSID only provides a summary of the key features of the Scheme. For details of the Scheme, please refer to the Trust Deed and the MPF Scheme Brochure of the Scheme. Copies of these documents are available via the following links and QR codes:

The On-going Cost Illustrations for the Scheme, a document which illustrates the on-going costs on contributions to constituent funds in the Scheme, is available via the following link and QR code:https://bit.ly/3JErWGc

The Fund Fact Sheets provide basic information (e.g. fund performance) on individual funds of the Scheme. Copies of these documents are available via the following link:Fund Fact Sheets

Personal Data Statement

To obtain the latest copy of the personal data statement, please write to the Data Protection Officer, Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong.

How to make enquiries and complaints?

If you would like to make an enquiry or a complaint, please feel free to contact us.

eMPF Customer Service Hotline:

183 2622

eMPF Service Centres:

Hong Kong Island: Unit 601B, 6/F, Dah Sing Financial Centre, No. 248 Queen’s Road East, Wanchai, Hong Kong

Kowloon: Suites 1205-6, 12/F, Chinachem Golden Plaza, No. 77 Mody Road, Tsim Sha Tsui East Kowloon

New Territories: Suite 1802A, 18/F, Tower 2, Nina Tower, No. 8 Yeung Uk Road, Tsuen Wan, New Territories

Fax number

3197 2988

Postal address

P.O. Box 98929, Tsim Sha Tsui Post Office